25+ excise tax ma calculator

The applicable percentages are set out in. Web Real estate tax proration.

Massachusetts Income Tax Calculator Smartasset Com

If you registered your car after January 31 we tax you from the month that you registered your car until the end of the year.

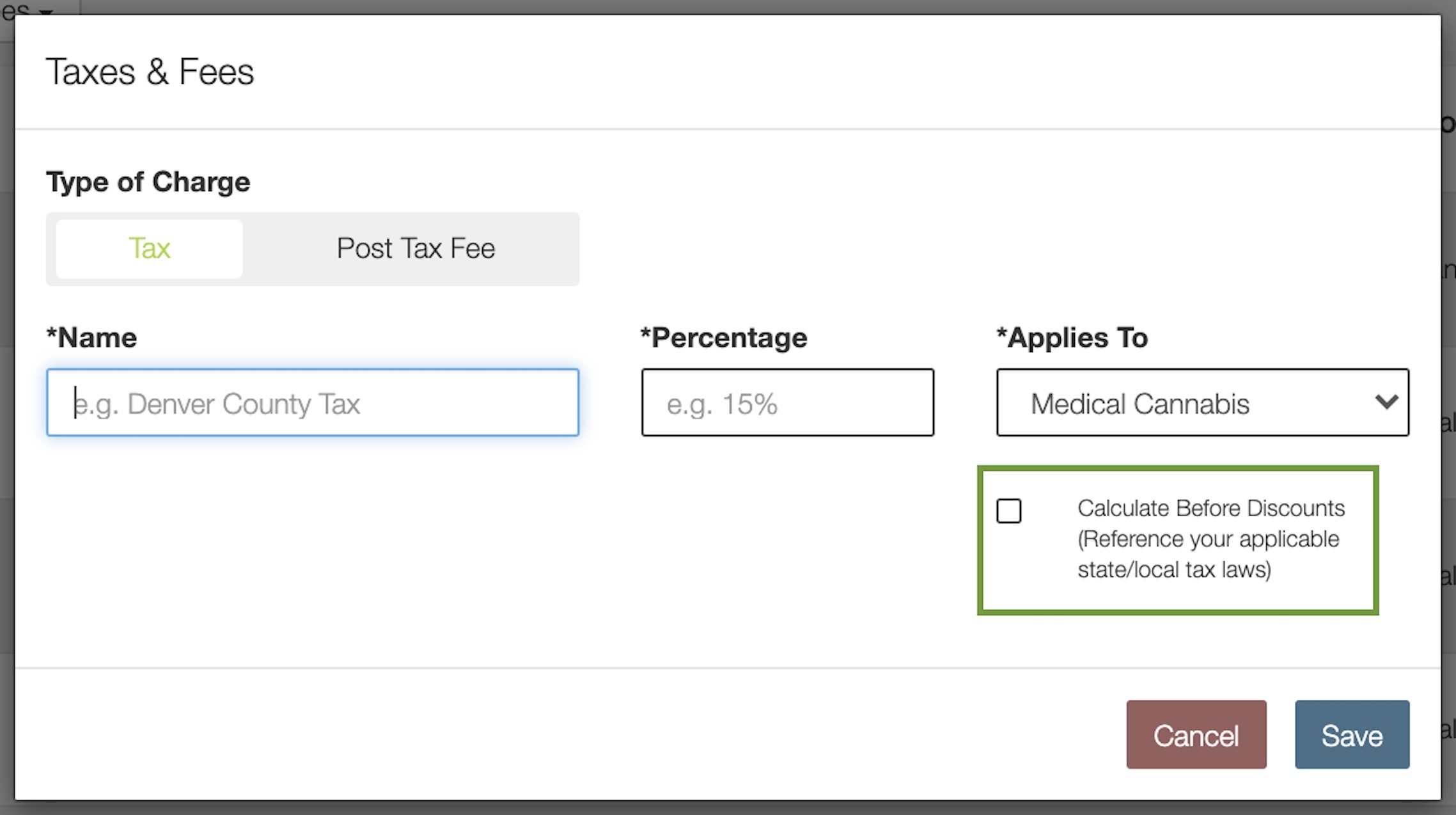

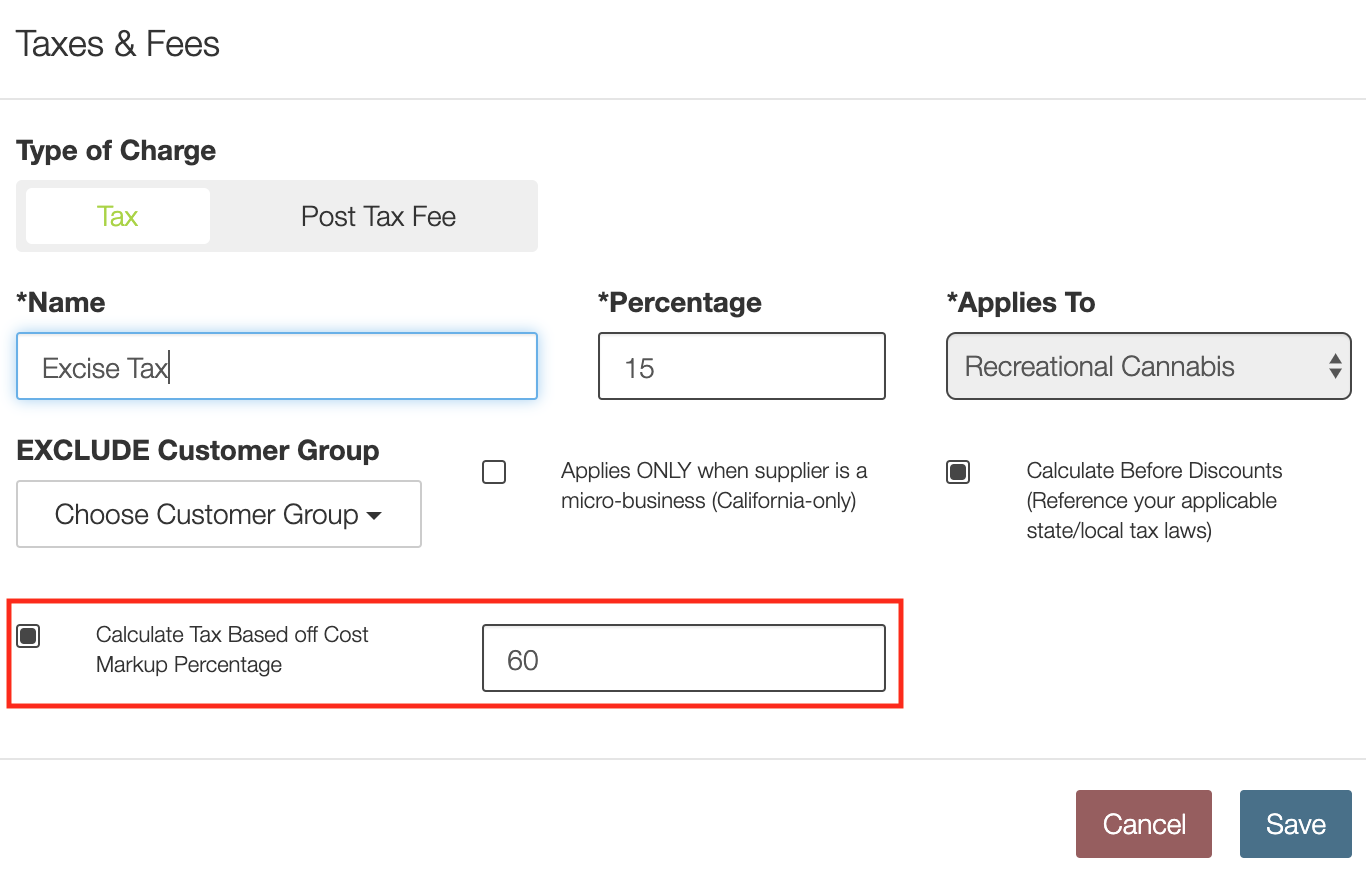

. Web Excise Tax Calculator This calculator will allow you to estimate the amount of excise tax you will pay on your vehicle. - NO COMMA For new vehicles this will be the amount on. Web Excise tax in Massachusetts The transfer tax rate is 456 per 1000 or fraction thereof of taxable value.

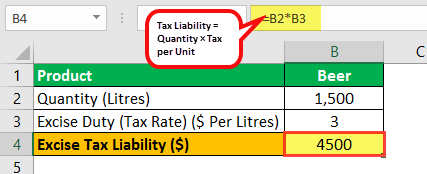

Purchase Amount Purchase Location ZIP Code -or- Specify Sales Tax Rate Massachusetts has a 625 statewide sales tax rate and does not allow local governments to collect sales taxes. Web The excise rate is 25 per 1000 of your vehicles value. Consideration of Deed Total Excise Amount.

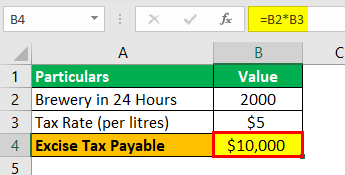

Excise tax is due 30 days from the issue date of the bill. Calculating the Excise 25 per 1000 of value The excise rate is 25 per 1000 of your vehicles value. The excise due is calculated by multiplying the value of the vehicle by the motor vehicle tax rate.

If your vehicle is registered in Massachusetts but garaged outside of Massachusetts the Commissioner of Revenue will bill the excise. Web Massachusetts Property and Excise Taxes Massgov Taxes offered by Massachusetts Department of Revenue Massachusetts Property and Excise Taxes Here you will find helpful resources to property and various excise taxes administered by the Massachusetts Department of Revenue DOR andor your citytown. Excise Tax Definition Types Calculation Examples Web Calculating Massachusetts Car Sales Tax.

Web Our income tax calculator calculates your federal state and local taxes based on several key inputs. The excise rate is calculated by multiplying the value of the vehicle by the motor vehicle. Excise abatements are warranted when a vehicle is sold traded or donated within the year or has been registered in another state.

Web Excise Tax Calculator The effective tax rate is 228 per 500 or fraction thereof of taxable value. To find out the value of your car you will have to visit the Massgov website and refer to the Motor Vehicle and Trailer Excise Manual that can be downloaded. Web The excise rate is 25 per 1000 of your vehicles value.

Web Excise tax bills are calculated with a tax rate of 25 per one thousand dollars of valuation. If a vehicle is registered for any part of a month the tax will be due for all of that month. Youll need to pay a prorated amount if you close before paying your current quarters taxes.

Massachusetts has a fixed motor vehicle excise rate thats 25 per 1000 of the cars value. It is charged for a full calendar year and billed by the community where the vehicle is usually garaged. Web Excise Tax Calculator This calculator will allow you to estimate the amount of excise tax you will pay on your vehicle.

If your vehicle is registered in Massachusetts but garaged outside of Massachusetts the Commissioner of Revenue will bill the excise. All bills must be paid in full within the 30 days. It is charged for a full calendar year and billed by the community where the vehicle is usually garaged.

There is no excise tax due where the consideration stated is less than 10000. Massachusetts homeowner property taxes are due every three months on August 1 November 1 February 1 and May 1. Enter your info to see your take home pay.

EXCISE TAX CALCULATOR The excise tax is 228 per 500. Web 25 excise tax ma calculator Jumat 24 Februari 2023 Enter your vehicle cost. The value of a vehicle for the purpose of the excise is the applicable percentage for that year of the manufacturers suggested retail price for that vehicle.

Web Calculating the Excise 25 per 1000 of value The excise rate is 25 per 1000 of your vehicles value. Web SmartAssets Massachusetts paycheck calculator shows your hourly and salary income after federal state and local taxes. Web The statutory excise rate is 25 per thousand dollars of value.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. You are taxed at a rate of 25 per thousand dollars of your cars value. Web The minimum excise tax bill is 5.

For any consideration over 10000 please use the Excise Calculator below to determine the required excise tax. Web Excise Tax Calculator Franklin County Registry of Deeds. Web We use that information to figure out your excise tax.

Excise tax bills are prorated on a monthly basis. Your taxes must be current through your closing date. A net income measure and Either a property measure or a net worth measure The income measure is calculated at a rate of 8 of the corporations.

Enter your vehicle cost. The excise tax rate is 25 per 1000 of assessed value. Web Calculating Massachusetts Car Sales Tax.

Your household income location filing status and number of personal exemptions. Web The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Consideration between 100 and 10000 is not subject to excise tax.

World Development Report 2020 By World Bank Group Publications Issuu

S 1 A

Sales Tax Calculator

The Economics Of Wind Energy European Wind Energy Association

Opencart Avalara Tax Manager Automated Tax Integration Module Webkul

Excise Tax Examples Top 3 Practical Example Of Excise Tax Calculations

Def 14a

California Cannabis Taxes A Quick Guide For Retailers

Dwix Hntknwomm

Country Profile

Country Profile

Certain Information Has Been Removed Or Redacted From The Text To

Excise Tax Definition Types Calculation Examples

Feye L Woods Resume 0916

Pdf Effectiveness Of Tax And Price Policies For Tobacco Control Sophia Delipalla Academia Edu

Revised Rfp Selection Of A System Integrator Haryanatax Com

S 1 A