Current price of bond calculator

The algorithm behind this bond yield calculator takes account of these variables. Therefore the current yield of the bond is 600.

How To Calculate The Current Price Of A Bond Youtube

A typical household which according to.

. Current Yield Annual Coupon Payment Current Market Price of Bond. Current Yield 60 1000. Calculate Bond Price if.

The tax-free equivalent is 4615 x 1-35 which is 3. Bond pricing allows investors. Enter the bonds trading price face or par value time to maturity and coupon or stated interest rate to.

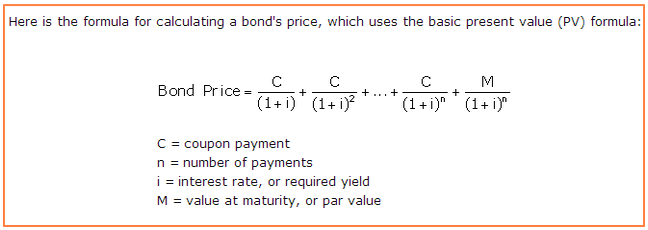

Bonds coupon rate interest rate. The calculator uses the following formula to calculate the current yield of a bond. The formula for calculating YTM is.

That is if a bonds par value is 1000 and. Annual Interest Payment Face Value - Current Price Years to Maturity. To calculate a value you dont need to enter a serial.

The Calculator will price paper bonds of these series. This calculator shows the current yield and yield to maturity on a bond. Calculator Results for Redemption Date 092022.

HOW TO SAVE YOUR INVENTORY. This will be achieved by an Energy Price Guarantee EPG. On this page is a bond yield calculator to calculate the current yield of a bond.

Using the free online Current Yield Calculator is so very easy that all you have to do to calculate current yield in a matter of seconds is to just enter in the face value of the bond the bond. CY is the current yield C is the periodic coupon. Working the previous example backwards suppose you calculate a yield to maturity on a taxable of 4615.

Par is the amount of money that the bond issuer needs to repay on the maturity date. What is the bond price. Bonds current clean price is the market selling price today.

With links to articles for more information. Face Value Current Price 2. Its still an increase of around 27 from the current price cap of 1971.

The formula for the approximate yield to maturity on a bond is. Bond pricing is the science of calculating a bonds issue price based on the coupon par value yield and term to maturity. EE E I and savings notes.

Bond price is calculated as the present value of the cash flow generated by the bond namely the coupon payment throughout the life of the bond and the principal payment. Annual coupon rate is 6. CY C P 100 or CY B CR 100 P.

You can easily calculate the bond price using the Bond Price. Use the bond current yield formula. Current Yield 600.

Of course you can also calculate it using our bond price calculator. Last but not least we can find the final result using the bond. Bond traders usually quote prices per 100 of Par Value.

Find out what your paper savings bonds are worth with our online Calculator. The Savings Bond Calculator WILL. In order to calculate YTM we need the bonds current price the face or par value of the bond the coupon value and the number of years to maturity.

Bond face value is 1000. Calculate the value of a paper bond based on the series denomination and issue date entered.

Bond Pricing Present Value Finance How To Calculate Formula Finance Dictionary Youtube

Yield To Call Ytc Bond Formula And Calculator Excel Template

Bond Yield Calculator

How To Calculate Bond Price In Excel

Bond Pricing Formula How To Calculate Bond Price Examples

How To Calculate Bond Price In Excel

How To Calculate Pv Of A Different Bond Type With Excel

Excel Formula Bond Valuation Example Exceljet

Bond Price Calculator Online Financial Calculator To Calculate Pricing Valuation Of Bond Based Financial Calculator Financial Calculators Price Calculator

Quick Guide On Bond Prices And Formula Bond Calculator Pricing Market Consensus

Bond Valuation A Quick Review Youtube

Zero Coupon Bond Formula And Calculator Excel Template

How To Calculate Bond Value 6 Steps With Pictures Wikihow

Bond Pricing Formula How To Calculate Bond Price Examples

Bond Price Calculator Exploring Finance

Zero Coupon Bond Value Formula With Calculator

Coupon Bond Formula How To Calculate The Price Of Coupon Bond