17+ Bonus Depreciation Calculator

Calculations for 2022 will be simple because the bonus depreciation rate is 100. Web The following calculator is for depreciation calculation in accounting.

Irs Sec 179 Deduction Calculator

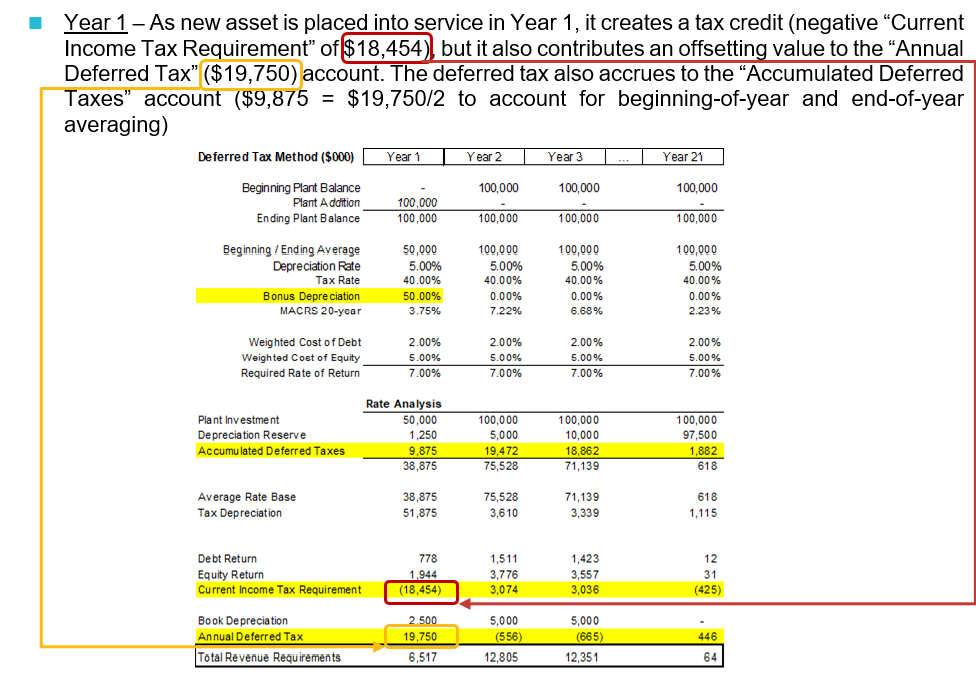

First bonus depreciation is another name for the additional first year depreciation deduction.

. Web The CARES Act permanently codified that QIP has a 15-year recovery period as well as the 20-year alternative depreciation system ADS recovery period. Section 179 Deduction Calculator See How Much. Web What Are The Specific Changes to Bonus Depreciation 168k.

Web Bonus depreciation is a provision in Section 168 k in the US. Web Depreciation Calculator Calculate depreciation compare methods and print schedules for the most common depreciation methods including straight line. If you are using the double.

Industrialist Sam an industrialist purchases equipment for the manufacturing units of his factories at 10000000. Web Bonus Depreciation Calculator. As the equipment becomes a part of.

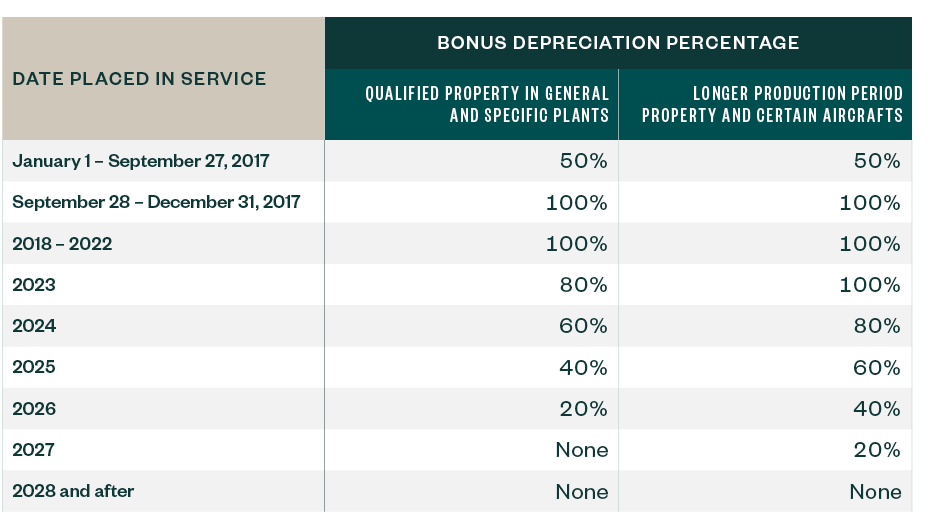

Web The bonus depreciation amount is determined using the years bonus depreciation rate. Web Examples 1. C is the cost or basis of the.

BD represents the bonus depreciation amount. The bonus depreciation calculator is on the right side of the page. Web The Protecting Americans from Tax Hikes Act of 2015 allows 50 bonus depreciation for qualified property placed in service between 1115 and 123117 40 bonus.

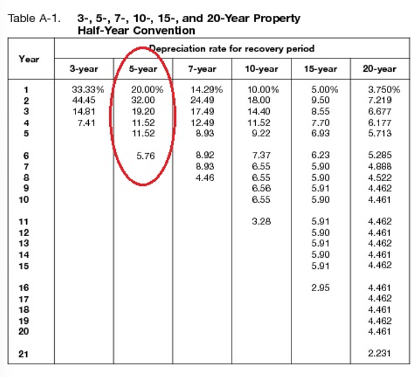

Web You can define the following types of depreciation methods. 2023 Section 179 Deduction threshold for total. Web Period Results The calculator uses the following formulae.

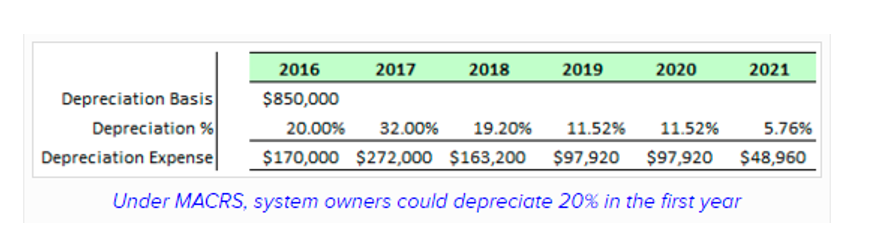

It is free to use requires only a minute or two and is relatively accurate. Web With the bonus depreciation rate at 100 for 2022 your bonus depreciation calculation would be. Web The MARCS depreciation calculator creates a depreciation schedule showing the depreciation percentage rate the depreciation expense for the year the accumulated.

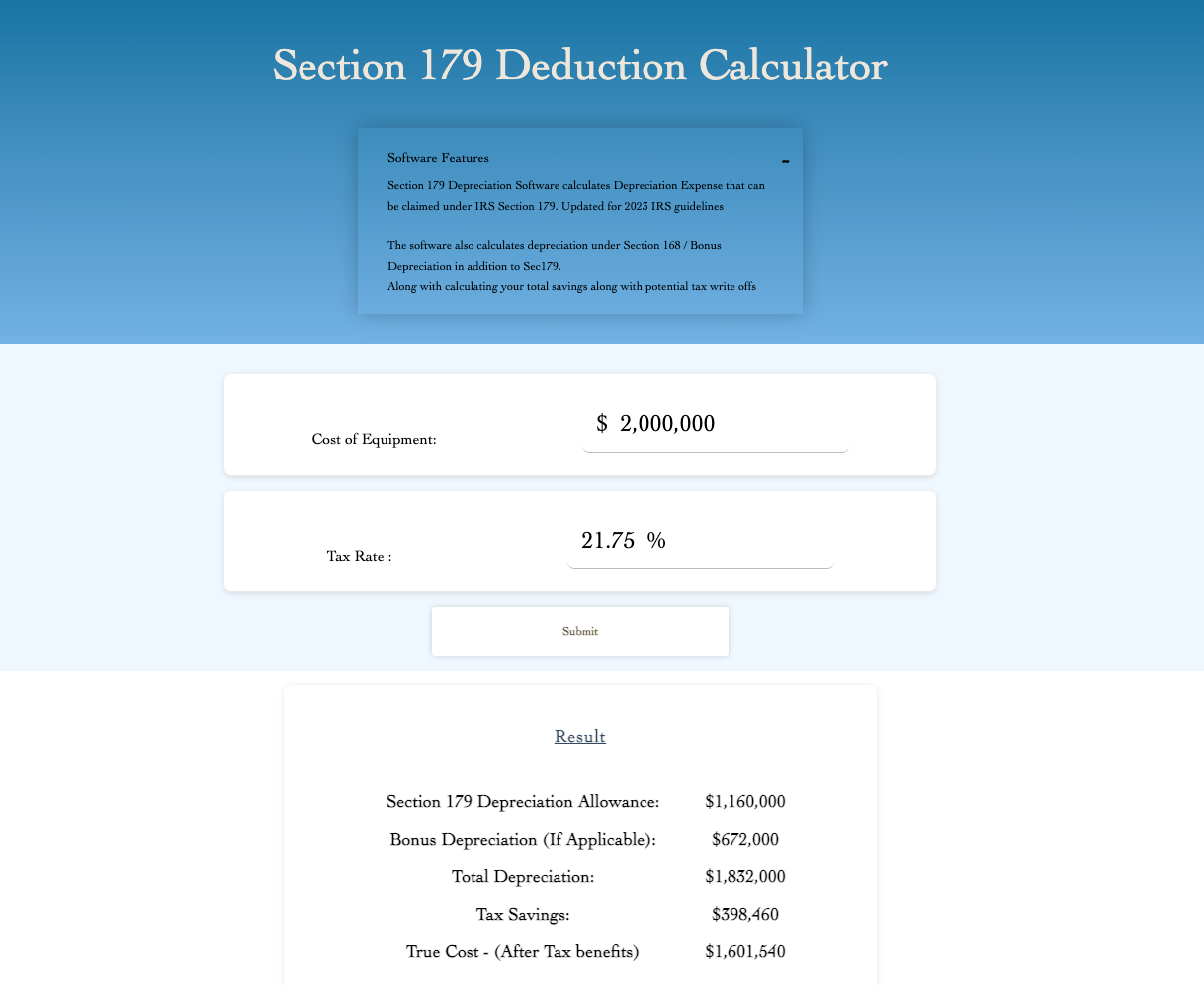

Web Use this Section 179 calculator to determine your cost-savings when using Section 179 deductions and bonus depreciation. Web Please explain used property as it relates to bonus depreciation. Web Enter the cost or basis of the asset the bonus depreciation rate and the tax year into the calculator to determine the bonus depreciation.

Depreciation Amount Asset Value x Annual Percentage Balance Asset Value - Depreciation Value You may also. Web 100 bonus depreciation for 2023 new and used equipment allowed. Web To calculate bonus depreciation you can use the following formula.

BD C R T 100. Buy a qualified business asset Most asset purchases your business plans to depreciate are eligible for bonus depreciation in the year purchased and placed in. Starting on January 1 st 2023 for assets placed in service during the following periods the bonus.

Tax Code that allows you to deduct the cost of certain assets in the year they are purchased. Section 179 deduction limit is now 1160000. It takes the straight line declining balance or sum of the year digits method.

100 x 15000 15000 This means that the bonus depreciation. Calculated straight-line Calculates the annual depreciation rate by.

Explore Tax Laws That Could Impact Business Cash Flow

Bonus Depreciation Manufacturing Impact Industry Today Leader In Manufacturing Industry News

Equipment Financing And Section 179 Calculator For 2023

Case Book Mit Sloan 2011 Pdf

Section 179 Tax Deduction Calculator Matsuura Machinery Usa

Macrs Depreciation Calculator With Formula Nerd Counter

New Safe Harbor Rules For 100 Bonus On Luxury Autos Sage Fixed Assets Support And Insights Sage Fixed Assets Sage City Community

Bike Insurance Calculator Two Wheeler Insurance Premium Calculator

Primer On Bonus Depreciation Scottmadden

Free 2021 Section 179 Calculator Learn How Much You Can Save

What Is Macrs Depreciation

Caliber Car Wash 17 Years Remaining Potential 80 Bonus Depreciation 1 50 Annual Increases Palatka Florida

Primer On Bonus Depreciation Scottmadden

Equipment Financing And Section 179 Calculator For 2023

Section 179 Bonus Depreciation Saving W Business Tax Deductions Envision Capital Group

Difference Between Bonus Depreciation And Section 179 Difference Between

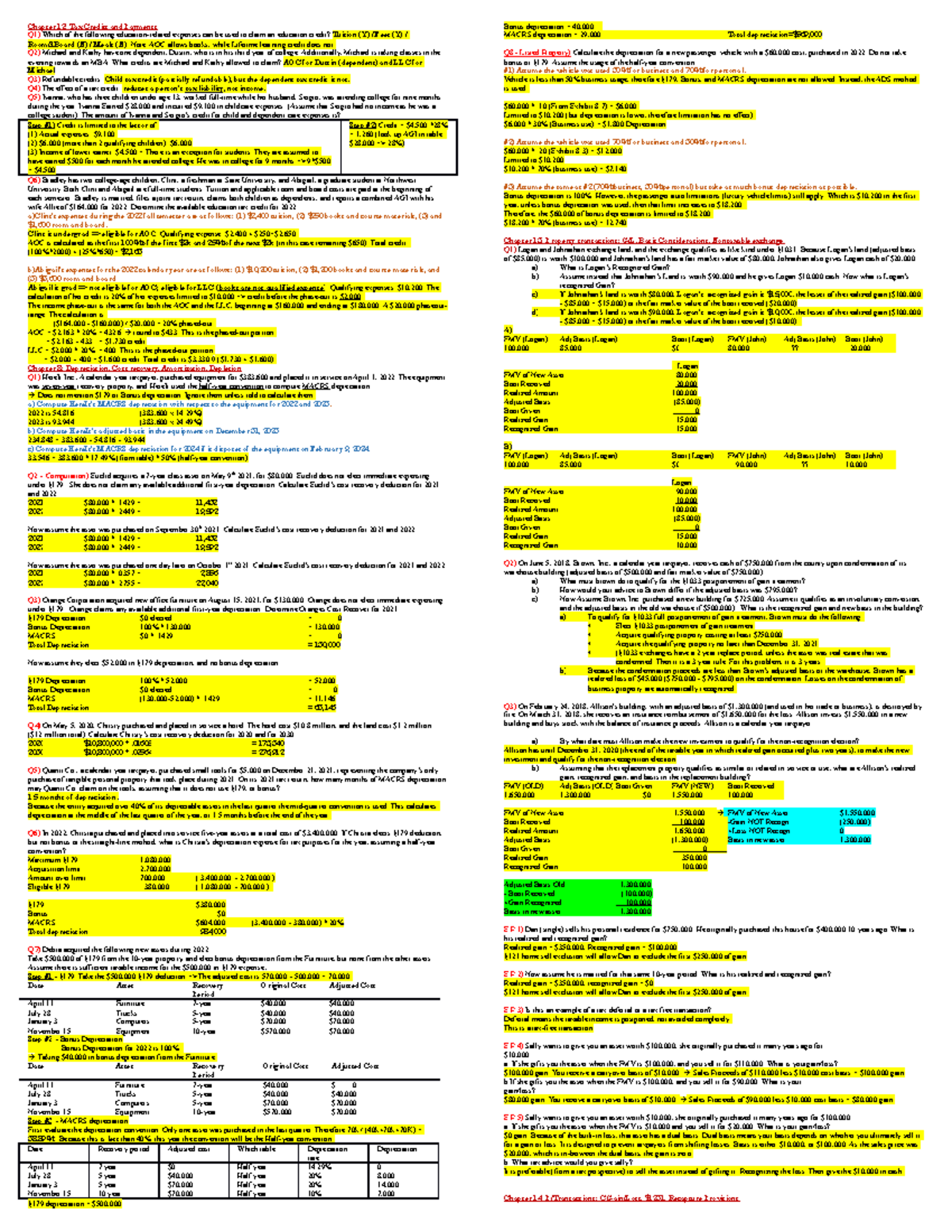

Exam 3 Cheat Sheet Ch12 8 13 14 Chapter 12 Tax Credits And Payments Q1 Which Of The Following Studocu